e-AMIS, the intuitive wealth management system that covers the entire investment process.

e-AMIS OVERVIEW

e-AMIS, the comprehensive asset management and information system, supports the entire investment process in portfolio management. Family offices, banks, asset managers and other financial service providers appreciate the wide-ranging functionality and intuitive nature of the software. With its flexible architecture and innovative technology, e-AMIS allows efficient management of investments. Portfolio managers and investment advisors use e-AMIS to improve the quality of their advice and guarantee optimum customer assistance.

e-AMIS MODULES

Customer Management

- Recording of ‘potential’ customers including profiling (KYC) and PEP check

- Creating investment proposals

- On-boarding of customers

- Document Storage

- Journaling features, including customer notes

- Graphic visualisation of participations and family relations

- Automatic calculation of management fee and performance fee

- Covering regulatory requirements such as MiFID II and FIDLEG

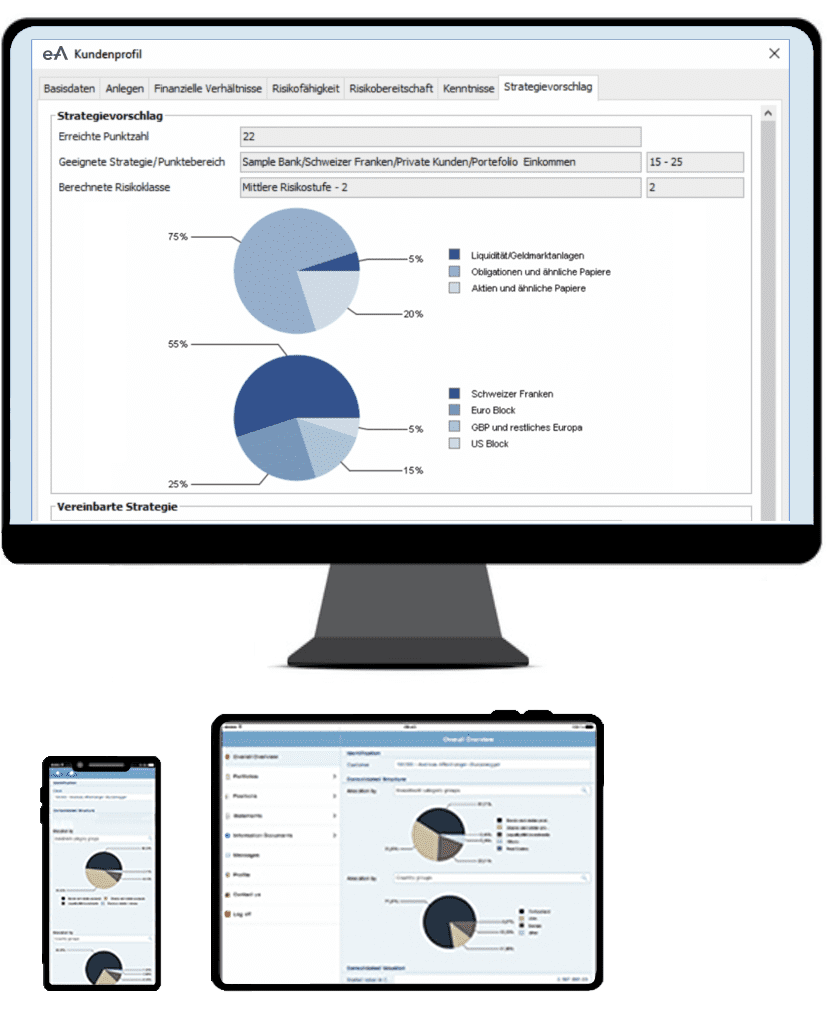

RISK PROFILING

- Consultation and customer profiles recorded and stored

- Creation of a customer profile is based on personalised questionnaires

- Risk classification by scoring

- Configurable formula, proposal for the investment strategy

MOBILE CLIENT

- Investor front end

- Direct internet access to inventory

- Provide client individual reports

- Secure communication with the asset manager

- Access from tablet or mobile phone

Analysis

- Any portfolio structures with flexible consolidation (e.g. over multiple custodians)

- All asset classes (incl. non-liquid assets)

- Asset allocation by asset category, currency, industry, country, duration, key ratio, etc.

- Investment simulations and market scenarios (changes in price, currency, and interest)

- Comparison of target/actual values

- Cashflow projection

- Performance measurement and risk management including Value at Risk (VaR)

- Analysis including open transactions (order management)

- Breakdown of funds (look-through), indexes and structured products

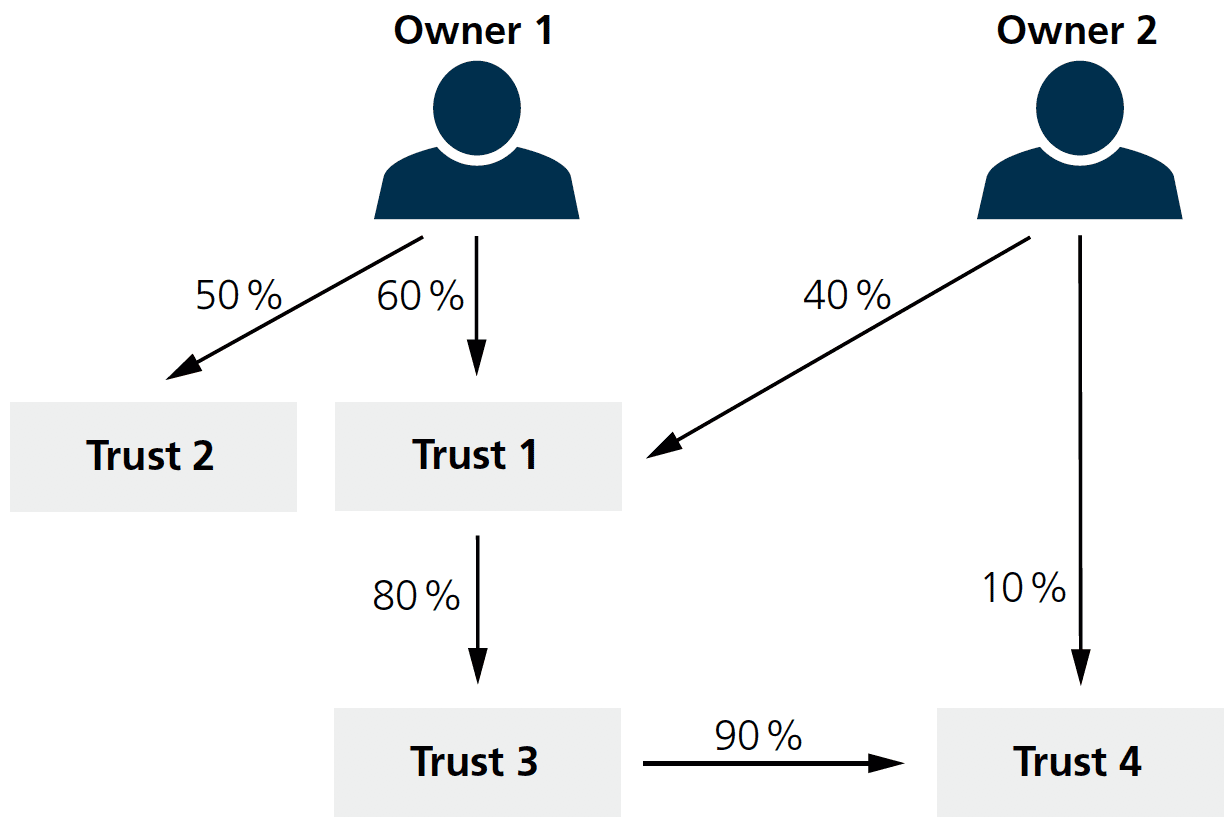

OWNER STRUCTURES

- Definition of complex structures of investment companies or trusts

- Managing individually and evaluating on a consolidated basis

- Consolidation at every level incl. Performance, VaR

Strategy

- Specific investment strategy for each customer profile

(strategic asset allocations) - Combination of sectors such as asset categories, countries,

currencies, durations, industries, etc. - Definition of mixed benchmarks for performance comparison

- Maintenance of model portfolios using sub structures

- Recommendation lists on titles

PORTFOLIO REBALANCING AND CONSTRUCTION

- Periodic adaptations of portfolios to the target structures

- Global portfolio construction allows rebalancing of many portfolios simultaneously

- Sector switches, action of single securities, new issues

- FX hedging and opening of money market contracts

Execution

- Investment proposals for prospects

- Restructuring proposals, for example, to illustrate a change in strategy

- Manual or automatic proposals (based on model portfolios)

ORDER MANAGEMENT

- Order generation from rebalancings

- Pooling from the trading desk

- Configurable order routing

- Order status can be tracked (entered, assigned, placed, executed, etc.).

- Settlement Matching

- Import and export order and transaction data

- Allocation of all transactions incl. partial trades

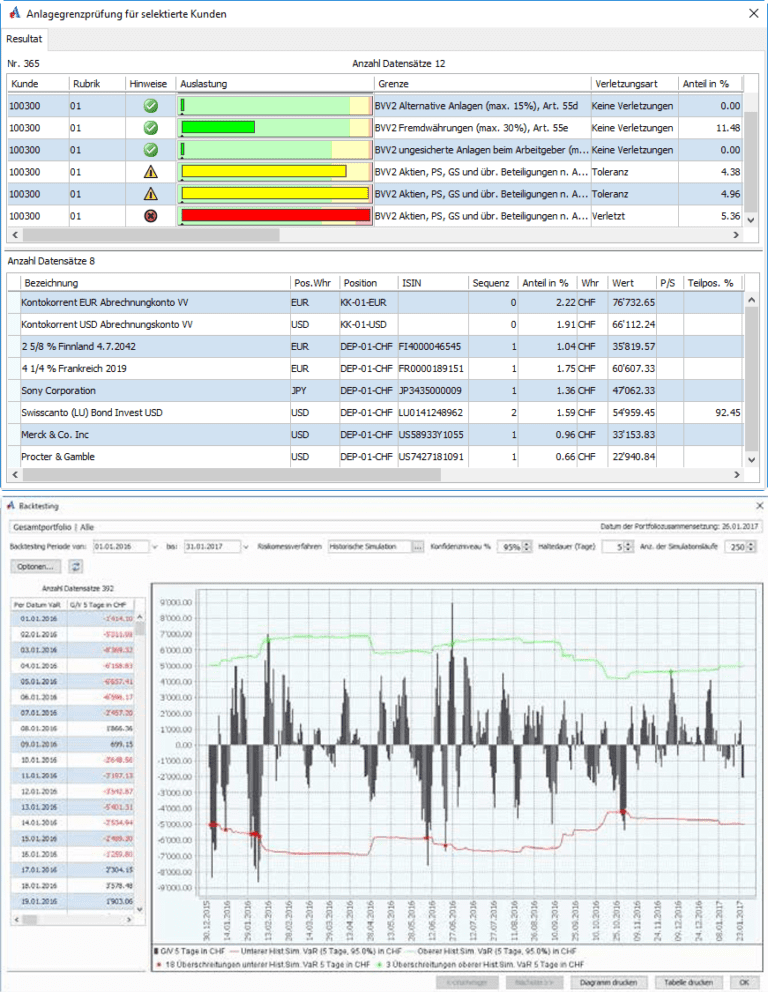

Monitoring

- Daily monitoring of investment limits in accordance with legal guidelines, internal company directives and investor-specific requirements

- Pre and post trade investment compliance

- Audit-compliant persistence of results

- Complying with MiFID II and FIDLEG guidelines

- Verification at portfolio, customer or customer group level

- Central monitoring of all violations

RISK MANAGEMENT

- Value at Risk (VaR) absolute or relative, shortfall risk

- Risk key ratios calculated (target performance resp. shortfall risk, conditional VaR, etc.) can be flexibly adjusted using parameters such as risk model, holding period, confidence level)

- Risk key ratios are calculated on individual, sector or category, and portfolio levels (single or consolidated portfolios)

- Clean and dirty backtesting

- Risk/return comparison

PERFORMANCE MEASUREMENT

- MWR and TWR in the absolute and relative performance measurement of consolidated portfolios down to single position and to different reference currencies

- Gross and net performance

- Contribution and classic attribution

- Key ratios such as information, Sharpe and Treynor ratio as well

as maximum drawdown and tracking error - Global Investment Presentation Standards

Information

- Standard customer reporting individually composed of dozens of modules

- Flexible configuration regarding font, colors, logo, language and various content settings

- Third party information (fact sheets, minutes, etc.) can be merged

- Mass reporting engine

- Various management reports

- Individual data output using the Query module

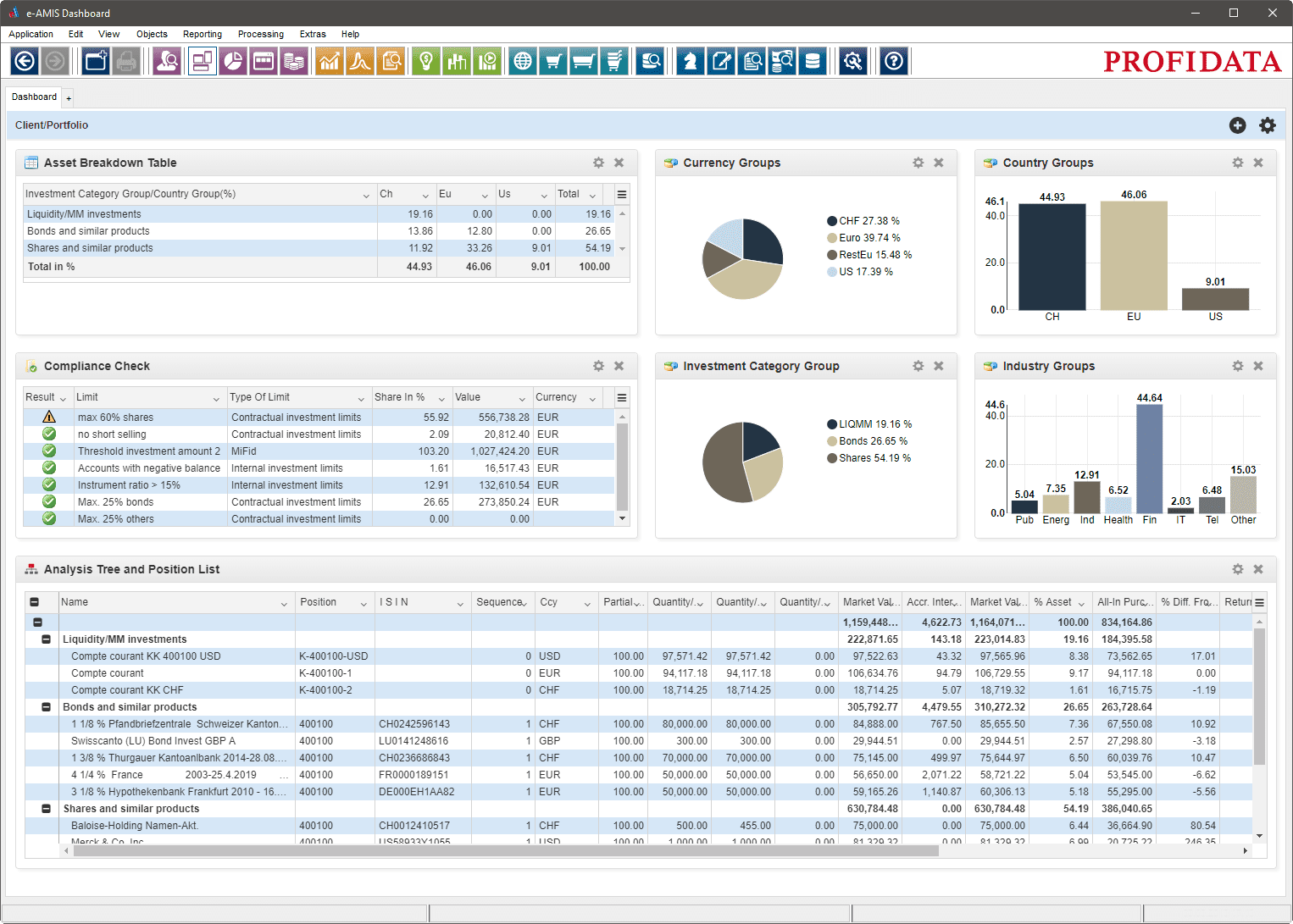

DASHBOARD

- Customisable overviews

- Selectable views for information on asset structure, position overview, target/actual value comparison, investment limit testing open orders

Accounting

- Standardised transaction types (trades, interest and dividend

payments, corporate actions, etc) - Chronological transaction history can be retrieved for each position

- Intraday position management with presentation of open transactions

- Transaction generation for events, rebalancings or fees

- Definable position separating criteria (e.g. for blocked assets)

BALANCING

- Transaction items are posted according to standardised or

customer-specific charts of accounts - Use of different charts of accounts for evaluation views

(net and gross performance) and/or the performance before

and after fees and/or taxes, is presented - Processing of cancellations, depreciations and period closings.

FEES CALCULATION

- Asset- and performance-dependent as well as

combinable fee models - Versioning of tariff structures

- Pro-rata calculation at entry and exit

- Manually adjustable fee calculations

- Report of all transaction fees

- Charge of fees and transaction generation

Data Management and Integration

- Configurable parameterisation and master data

- Auditing

- Historicisation

- Granular authorisation concept for accessing data and functions

- Multilingualism

- Multi-client capability

INTEGRATION

- Standard interface for linking third party applications, core banking systems, etc.

- Generic depositary bank interface

- Master and market data interfaces (SIX Financial Information, Bloomberg, Reuters, etc.)

- Staging Area

- Standardised export functions

- MS Excel integration

CONTACT

Marcel Schwertfeger

Head e-AMIS

+41 44 736 47 47

info(at)profidata.com

Dr. Frank Jenner

Business Development & Marketing

Member of the Management Board

+41 44 736 47 47

sales(at)profidata.com